Overview

Sandfire Resources NL (ASX: SFR) is a copper-gold exploration company based in Perth. Listed on the Australian Securities Exchange (ASX) in 2004, Sandfire Resources was later added in the ASX 200 index in 2010 (not to be confused with ASX 100). Their Copper-Gold mine, DeGrussa, has been one of the best finds made in the history of Western Australia and has since been serving Sandfire Resources with good revenues.

The company is being categorized as a Small Core company by Morningstar despite it being one of the largest copper producers in Australia.

Main Projects

Australia: DeGrussa Mine , Monty Mine

USA: Black Butte Copper Project

Alaska: Zinc VMS project

Bosnia and Herzegovina: Rupice project

|

| Assets Overview |

Financials

Sandfire’s revenue and assets have been steadily rising while net profits are surging at an even faster pace. Cash balances are picking up since year 2016. All these good signs are largely attributed to the long economy growths which favor copper prices.

|

| Source: DBS Vickers |

Current Ratio is at 3.80 when a measure of minimum 2.0 is suffice to justify a healthy balance sheet.

This indicates that Sandfire will be strong enough to pay off its obligations for a sustainable period of time during poor industry or economy conditions.

It must be emphasized that about 87% of Sandfire's revenue comes from copper, 11% from gold and only 1% is from silver. In my last post, I shared about the characteristics of copper and gold. Cooper prices tend to rise during economy growth while gold prices tend to rise during economy "doom".

|

| Annual Report 2017 |

Growth

Growth in copper commodity is supported by the rising demand in Electric Vehicles (EV) and its related infrastructures. Moreover, future copper supply is foreseen to fall short to its future demand. When this happens, it places copper producers at a good spot to command higher prices.

Thus, it is not alarming that Sandfire's revenue is expected to grow 11% annually.

Valuations

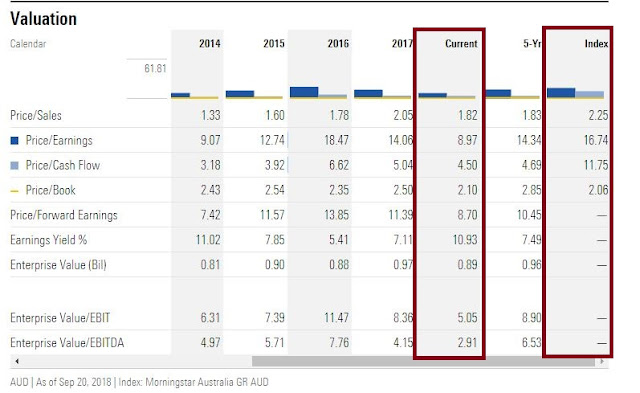

While Sandfire's shares are selling at about 2 times Price to Book Value, this is closely aligned to its industry's index. Looking closer at other measures, its shares are considerably cheaper than its peers in terms of Price to Sales , Price to Earnings and Price to Cash Flow.

|

| Source: Morningstar |

Its Price/Earnings to Growth (PEG) ratio stands at only 0.81 (P/E: 9.0 over 11 percent growth), which is quite attractive.

By Comparing Sandfire's P/E with 3 of its Australian peers, it has a much cheaper P/E and yet distributes a substantially higher dividend.

P/E: 9 , Dividend: 4.00%

P/E: 60 , Dividend: 0.84%

Independence Group (ASX: IGO):

P/E: 51 , Dividend: 0.70%

Northern Star Resources Ltd (ASX: NST):

P/E: 27 , Dividend: 1.10%

It must be reminded that this is not a full apple-to-apple comparison as the 4 companies deal with a different range of metals and commodities.

Dividends

The dividends issued by Sandfire are fully-franked and thus will not be taxed on shareholders. This is also because the company has already paid taxes. "Franked dividends" is a term that prevent double taxing in Australia.

|

Risks

Underground mining is an extremely dangerous activity. In each mining accidents or cave collapse, many lives can be lost. This leads to long mining downtime and loss of employees.

Both the company’s reputation and profitability can be instantly and adversely affected if such accidents were to occur.

As Sandfire deals with commodities, revenues can be easily swayed by price fluctuations of Cooper, Gold and Silver. As an example, we had witnessed and are still witnessing how low oil prices have affected the profitability of companies such as Exxon Mobil and Keppel Corp.

With almost 90% revenue coming from cooper, financial position of Sandfire will go on a downward spiral during economy dooms since cooper is an economic indicator.

Its main mine, DeGrussa, is also forecasted to last till year 2022, which is only 4 years away (despite new investments and assets made in other regions as shared earlier)

Strengths

-DeGrussa owns one of the world's reportedly largest off-grid solar. Sandfire has been moving its dependence from diesel power to renewable energy by investing in solar systems. With solar energy, Sandfire can save an estimated 5 million litres of diesel per annum. (below video)

-Diversified its portfolio in USA via 78% stake in Black Butte Copper Project

-Rising copper demand along with lack of copper supply sources

-Offers shareholders about 11% hedge from gold (based on revenues)

-Low cost producer, zero long term debt and stable cash flows

-6 years of safe mining operations

To Sum It Up

Sandfire Resources is still growing as a company , has 4% dividend yield, healthy financials and cheaper share price valuations to peers. AUD/SGD is also currently trading at 5 year low of S$0.99, which makes it cheaper for Singapore investors. While there are still risks to consider, my research showed that the pros far outweigh the cons.

I have bought some Sandfire shares before it went ex-dividends on 10th September. (though it is advised to buy shares after ex-dividends)

These are the shares which I hesitated to buy way back in 2017 when it was much cheaper.

Let's see how it goes and I may even add more if it gets cheaper.

Disclaimer:

Writings made in this blog are based on opinions and findings. The writer/author of this blog is not liable on any liabilities or losses that arises from the contents of this blog

Information shared in this blog does not guarantee completeness or accuracy.

Subjects, demographics, currencies, shares or companies mentioned in this blog does not indicate as investment recommendations but solely for discussion and sharing purposes.

No comments:

Post a Comment