As mentioned in the previous post, I will run through the five companies currently held and share my research and opinions.

Singapore Telecommunications (Z74)

As a stalwart, Singtel is a slow investment and mainly for those with stable yield appetite who has large capital injections. (I am surely not one of those)

Recently, dividends were announced to be stabilized for the next two years which is good news.

The upcoming competition from TPG shall affect Singtel the least among the 3 existing telecoms , and Circles Life still has to pay Singtel to remain incumbent. So does it still look as bad?

Maybe yes, as seen from the additional competition in Australia and India.

Singtel should however be strong and stable enough not to be easily shaken.

|

| Singtel's Net Income Growth (morningstar.com) |

I felt that they may be facing a similar situation as what Comfortdelgro had from Uber and Grab earlier. In the end, we saw how Comfortdelgro made a “comeback”. It always seemed the worst at the start because we just want to be cautious.

Pondering on buying more in the $3.30 to $3.35 range. :)

Sanofi ADR (SNY)

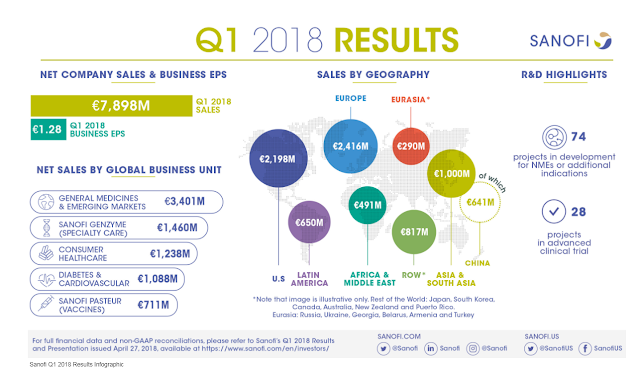

Sanofi is a another slow growth story with particularly large capitalization. It was the company which recently brought over Bioverativ, a spin off from Biogen. Bioverativ will be one of their potential engines in terms of driving future revenues and growths. As seen in the image below, Revenues and Net Income are consistently on a gradual uptrend, and ending in 2017 with a bang in Net Income.

Dividends payout percentage was once at a wary high of above 90% but has since dropped to 54.7% of net income in 2017. These explains the sweet annual yield at 4.8%. Another note is, dividends have been increasing for nearly 24 years. Price to book and PE ratio, as a guideline, is 1.41 and 17.75 respectively.

|

| Sanofi's Net Income Growth (morningstar.com) |

|

| Overview of Sanofi's revenue streams |

On a side note, the FDA is currently reviewing Sanofi's Zynquista- a treatment for Type 1 Diabetes.

Surprises to look out: Future potential R&D findings and favorable FDA/EMA approvals on new drug listings.

(Warren Buffett was also an investor in Sanofi since 2006, as I found out shortly after adding. It was not however a good returns stock for himself)

No comments:

Post a Comment